issue 1: scaling treasuries & market exposure through governance

sushi <> olympus token swap, frax attempts the big one, index raising $10M, i wonder what fei has been up to

welcome to the first edition of the .mthrbrd newsletter 🧙 .mthrbrd is a bi-weekly newsletter focused on the forum posts and governance proposals making waves in the dao ecosystem. you can follow us on twitter @TannirSami and @niallyorke for the latest updates.

this week:

olympus looks to conduct a treasury swap with sushi

index nears completion of its $10M treasury sale

frax stablecoin is close to a listing on aave

quick dive into fei stablecoin and tribe governance

grant daos continue to spend serious dough

p.s. for all of you who subscribed before we published this first issue (over 175 of you!) we will be sending out a seperate email containing the instructions to claim your exclusive .mthrbrd poap

hot off the press

🍣 🤝 (3,3)

last week, olympus passed a notion that approves the dao to pursue strategic swaps with its treasury holdings. following a new trend in the dao space of treasury<>treasury swaps to diversify holdings. the motivation behind this specific proposal was to increase $OHM use and utility as a liquid reserve asset (the whole purpose of olympus), and bolster olympus’s influence within the defi industry.

after passing that snapshot with flying colors, olympus has dashed ahead and created a forum proposal with its first potential strategic swap partner, sushi. already utilizing the dex in its own protocol mechanics, olympus community hopes to deepen its ties with the sushi folks on the following terms:

Execution at current 30-day moving average prices with no discount.

OHM 30-Day MA = $345.78

SUSHI 30-Day MA = $11.58

$3,300,000 notional value, paid in xSUSHI and sOHM.

242,736 xSUSHI <> 9544 sOHM

sushi holders are voting nearly 92% in favour of the swap at time of writing.

index coop raising 10 milli through their treasury

index coop, famous for their index tokens such as $DPI and $MVI are taking the final step in their $10 million treasury sale. closing the round with 92,759 INDEX tokens to sequoia capital, white star capital, and blockchain.com at a price of $24.26 $USDC per $INDEX (51% discount on current price). the $INDEX will unlock linearly following a 12-month cliff. investors will be permitted to vote with their vested tokens.

the daos working group in charge of this sale believe it will benefit the community by adding millions of stablecoins into the treasury, increasing institutional exposure, and onboarding high-quality strategic advisors.

the owls leading this sale had this to add:

“I firmly believe that Index Coop should set the standard for how DAOs interact with Venture Capital Funds. Both kinds of organizations have important lessons to learn from each other. I look forward to seeing a positive and collaborative discussion around this IIP. Regardless of our final decision, we welcome them into our community as colleagues and potential partners.”

frax be making waves recently

frax, the too early to call winner of the algo stable market has an interesting approach to scaling their user acquisition. rather then depending on arbitrage and peg-volatility to growing their volume and adoption (like most algo stables), the protocols core-team goes right to the heart of the defi goliaths governance systems and makes proposals too good to pass as to why they should add $FRAX, and in some cases, their governance token $FXS into their protocol.

in no order, they have either succesfully or nearly completed inserting their token into the ecosystems of curve, cream, compound, dhedge and more through forum discussions and governance proposals. this week, frax attempts to list on defi powerhouse aave… (maybe x2 soon…)

this strategy has been beyond succesful for the token as $FRAX now scales to multiple chains, has 1600+ holders, and over 100,000 transactions since its inception in December.

go help the frax community reach quorum in their live aave governance proposal!

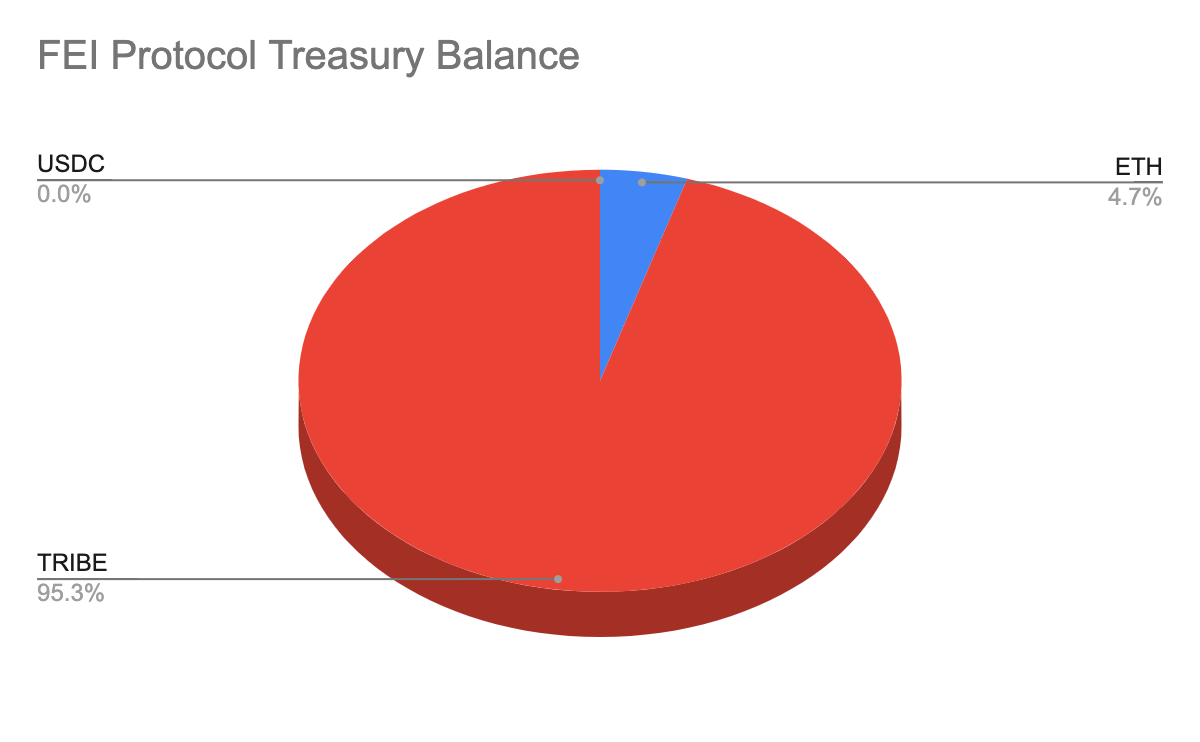

protocol of the week: fei

speaking of stablecoins, the two token economies formed with these pegged (or sometimes unpegged) assets have proven to create quite the interesting governance module case study. in “protocol of the week” we will give a brief overview on the statistics and community support behind the largest protocols in governance. this week, fei.

a core principle of fei protocol is its fully decentralized design and minimal dependence on any centralized assets or protocols on ethereum. beyond the inherent need for the initial protocol tuning, the fei dao uses the tribe governance token and is primarily responsible for two things: upgrades and integrations. the fei dao is forked from the compound governor alpha and timelock with a 2.5% quorum and 24 hour timelock delay.

total treasury balance: $13,222,517.55

engagement ratio: 18.38%

total voters: 306

total ballots: 781

holders: 14.43K

proposals: 18

fdv: $667.53M

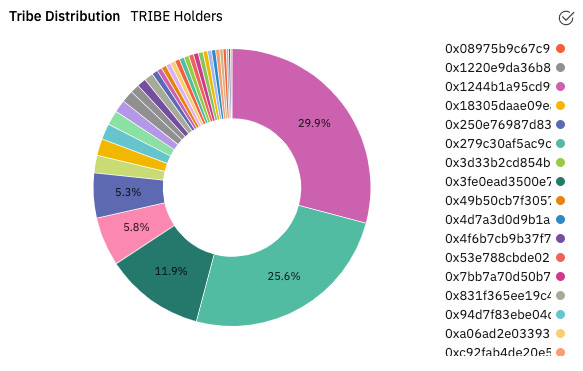

governance token distribution:

sources: tally, dune analytics, boardroom, etherscan